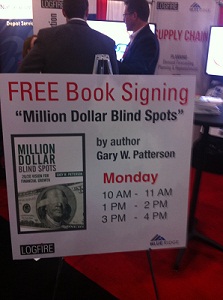

Seattle, Washington and Atlanta, Georgia – Enterprise risk management (ERM) expert and speaker Gary W. Patterson, FiscalDoctor®, book website http://www.milliondollarblindspots.com/ is now available.

Million Dollar Blind Spots best practices and processes will create clear understanding to uncover blind spots in your company—and will dramatically accelerate correct business leadership decisions.

Make the best decisions to grow your business today. You’ll learn how to:

- Avoid costly problems

- Increase profits

- Uncover your million-dollar blind spots

- Answer questions about why risk management is important to finding pockets of hidden cash

- Make faster business decisions

- Reduce functional silos

From the management of individuals, teams, departments, companies and divisions, there’s a potent mix of solutions in here you need to read, bookmark and make your own. Use this guide to grow efficiently, master real-world numbers, and identify and eliminate your organization’s costliest blind spots.

The book is part of the series including “Million Dollar Blind Spots”, followed by “Why Risk Management?: Systems for Making Informed Financial Decisions”, and then “Human Capital RX: The Fiscal Prescription for a Stronger HR Department.

Patterson works with leaders to uncover blind spots to make the best business decisions and dramatically accelerate correct fiscal leadership decisions. This helps leaders gain control of their financial destinies and capitalize on hidden high return opportunities, while limiting their exposure to risk. Patterson, a Big 4 CPA with a MBA degree from Stanford University, speaks regularly on topics such as corporate governance, risk management, strategic contingency planning, achieving corporate financial goals, leadership, and building long-term wealth.

About AudioInk

AudioInk boasts a powerful network of online distributors providing material worldwide. Our outlets involve such industry leaders as Apple’s iTunes, Amazon, B&N and more.

Founded in 2011, AudioInk Publishing, a division of Made For Success, Inc., is dedicated to providing authors and speakers the opportunity to make their Books, eBooks, Audiobooks, Speeches and other content available to leading retailers. AudioInk provides generous royalties and full service to extend the greatest opportunity to self-published authors. Great or small, everyone should have full access to distribute their work successfully. http://audioink.com/about/

About Gary W. Patterson

Gary W. Patterson, president & CEO of FiscalDoctor®, has been interviewed or presented internationally at over 70 of the leading and most prestigious publications and groups in the world and worked with over than 200 companies spanning supply chain, technology, transportation, construction, and service industries.

He authored “Stick Out Your Balance Sheet and Cough: Best Practices for Long-Term Business Health”, “The Fiscal Fitness System Understanding Balance Sheets, Income Statements, and Cash Flow” and “Find Your Million Dollar Blind Spots: 7 Thing You Need to Know”. For more information, visit his website at www.fiscaldoctor.com and his “free” fiscal fitness test at www.fiscaldoctor.com/fiscaltest.html. He can be reached at 678-319-4739.