Which of these three questions can improve the value of your strategic plan?

• How can you improve the emphasis from crafting impressive-sounding mission statements, core values and new initiatives with scant consideration given to the company’s real financial position?

• What part of your strategic vision will benefit from a fiscal focus to allow your company to feel more comfortable that its risk strategy is realistic, prudent and even doable, rather than suddenly realizing too late that you have bet the farm for too little reward?

• Where might there be some truth to the adage that far too many financial projections show revenues starting one quarter earlier than will actually occur, and expenses starting one quarter later than will actually occur?

Learn more about my recommendations. Risk & Compliance, a member of Financier Worldwide just published my article “Change A Risky Blue-Sky Strategy Into A Fiscal Vision Worth Its Weight In Gold” http://riskandcompliancemagazine.com/change-a-risky-blue-sky-strategy-into-a-fiscal-vision-worth-its-weight-in-gold

Financier Worldwide is a leading publisher of news and analysis on the global business and finance market place. With leading products such as the monthly print publication, Financier Worldwide Magazine, the organization has become recognized as a leading source of intelligence to the business and corporate advisory community. www.financierworldwide.com

They offer free subscriptions to qualified readers for publications on Corporate Disputes, Financier Worldwide and Risk & Compliance magazines. They are distributed globally from their United Kingdom publishing base.

**********************************************************************************************

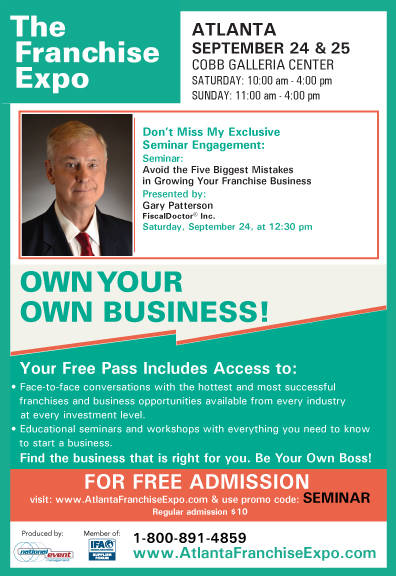

Consider discussing improving your sustainable profitable growth capabilities with the Gary Patterson. Clients call him their FiscalDoctor® and just as every person needs a medical doctor; every organization needs a FiscalDoctor and periodic fiscal checkups. He also supports special projects for strategic growth diagnostics, risk assessments, enterprise risk management (ERM), operational risk management (ORM), fiscal checkups, corporate governance, and strategic planning updates.

Call to discuss your situation at 678-319-4739 or send a note from https://fiscaldoctor.com/contact-us/