Several people have requested a copy of my draft version of a CAPEX policy. The disclaimer is that you need to revise this with the help of your CPA firm or advisory board etc to better fit your unique situation.

Dramatically Accelerate Correct Fiscal Leadership Decisions!

by fiscaldoctor

by fiscaldoctor

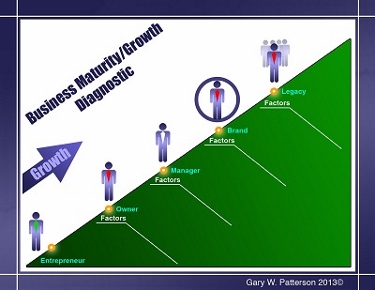

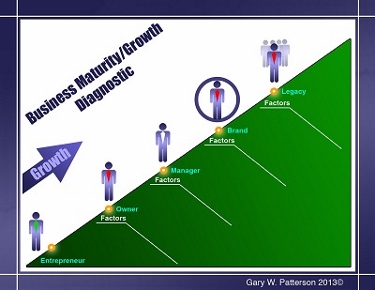

Many business leaders focus diligently on their company’s small, visible details only to be blindsided by the monumental and far more impactful events they didn’t see coming caused by one or more of those 5 biggest mistakes.

How might each blind spot affect your business?

1. Customer and product profitability Example, my business does not accurately know who its 10 most profitable customers are.

2. Change Example, my company does not know how changes at one of our top 10 customers would affect our own bottom line.

3. Overly optimistic balance sheet Example, my business occasionally capitalizes expenses that create assets with questionable recorded value.

4. Opportunity cost Example, my business has an asset it would be better off selling at a loss to free up cash to pursue a more promising opportunity.

5. Puffery Example, my business paints an overly optimistic picture of our company among customers, vendors, or financing sources.

File available as a download:

Avoid these 5 Biggest Mistakes in Growing Your Business

Other notes

by fiscaldoctor

ExecSense, Selects ERM/ORM Expert Gary W. Patterson to Lead Discussion

San Francisco, CA and Atlanta, GA – Gary Patterson, FiscalDoctor®, international enterprise risk management (ERM) and operations risk management (ORM) expert and speaker, was selected by the speaker board of ExecSense to lead a webinar titled “Best Practices for Establishing 2014 Goals for Your Management Team.” The webinar is now available at http://www.execsense.com/best-practices-for-establishing-2014-goals-for-your-management-team-cfo.html

Patterson’s webinar focused on the need to Drive responsibility through your management team, grow top line revenues and reduce risks and these key points:

Clients call him their FiscalDoctor® and just as every person needs a medical doctor; every business needs a FiscalDoctor and periodic fiscal checkups. He also supports special projects for risk assessments, enterprise risk management (ERM), operational risk management (ORM), fiscal checkups, corporate governance, strategic planning updates, and strategic growth improvement.

About Gary W. Patterson

Gary W. Patterson, president & CEO of FiscalDoctor®, has been interviewed or presented internationally at over 100 of the leading and most prestigious publications and groups in the world and helped over than 200 companies during 30 years, spanning supply chain, technology, transportation, construction, and service industries.

His most recent book Million Dollar Blind Spots: 20/20 Vision for Financial Growth provides best practices cutting edge follow-up for blind spots: how to identify them, and exploit opportunities and mitigate risk related to million dollar blind spots. Visit his website at https://fiscaldoctor.com and “free” fiscal fitness test at https://fiscaldoctor.com/fiscal-quiz/ , or call 678-319-4739.

© 2014 Gary W. Patterson. All rights reserved.tel. #. ###

by fiscaldoctor

Completed webinar on CEO Best Practices for Managing Expectations With Your Board of Directors for ExecSense.

by fiscaldoctor

Uncover Million $ Blind Spots to Assure Million $ Profits

January 8, 2014 – Atlanta, GA – Gary Patterson, FiscalDoctor® and enterprise risk management (ERM) and operations risk management (ORM) expert and speaker, suggests how you can move your bottom line from just OK to Great!

Part of the beauty of this process is the low cost to get started. You can complete this process with minimal if any capital expenditure requirements. Here’s how it plays out… During my discussion with client BK, I replied, “It sounds like your business operating results and supporting systems are OK, but not as good as they would be if you made some basic changes.”

How familiar does this sound? Let’s talk about where you are now, what organizational bliss would mean to you, and how to get there. You know where you want to be this year, and may have a specific vision of your 3 and 5 year goals.

What I suggested to BK, and possibly suggest to you, is:

1. First, look at which parts of your organization can build on strengths or accelerate opportunities underway.

2. Second, decide which of those areas would benefit from a fiscal health checkup. Examples to review could include financial statements, operating reports, unit level reports, cash flow projections, budgets, strategic plans, and long term financial planning.

3. Third, pick at least one area in the second step and get started.

Now, consider targeting a 1% improvement in your gross margin for any acceleration or improvements undertaken.

It’s important to note that most of you would accept moving from “OK” (pretty unhappy place to be for most leaders) to “at least good enough.” But, you can do even better and be surprised when you invest a little time off-site with these questions in order to spotlight at least one action to take with a potentially lucrative ROI.

Call to clarify any of these points, or help you get started moving your bottom line from just OK to Great!

About Gary W. Patterson

Gary W. Patterson, president & CEO of FiscalDoctor®, has been interviewed or presented internationally at more than 100 of the leading and most prestigious publications and groups in the world and helped over than 200 companies during 30 years, spanning supply chain, high tech, transportation, construction, and service industries.

His Million Dollar Blind Spots: 20/20 Vision for Financial Growth book provides cutting edge follow-up to the theme of blind spots: how to identify them, exploit opportunities and mitigate risk related to million dollar blind spots. This builds upon his earlier book Stick Out Your Balance Sheet and Cough: Best Practices for Long-Term Business Health. Visit his website at https://fiscaldoctor.com and “free” fiscal fitness test at https://fiscaldoctor.com/fiscal-quiz. Mr. Patterson can also be reached directly at +1(678)319-4739.

© 2014 Gary W. Patterson All rights reserved.

by fiscaldoctor

Fiscal Management Videos: Improve Financing, Risk & Profitable Growth

December 27, 2013 – Houston, TX and Atlanta, GA – Gary Patterson, FiscalDoctor®, expert on profitable growth rapidly, becoming more bankable and staying bankable, was selected by Chron to lead a present a series of videos on Fiscal Management. This series is available at http://smallbusiness.chron.com/fiscal-management-78092.html

Do you know how even great leaders with a great company face the challenge of not meeting their dreams? Well what Gary Patterson helps leaders do is to help them reach their dreams with improved financing, less risk, and profitable growth.

Long-Range Strategic Plans for Nonprofits http://smallbusiness.chron.com/longrange-strategic-plans-nonprofits-78094.html

Cost Effective Procedures in Supply Chain Management http://smallbusiness.chron.com/cost-effective-procedures-supply-chain-management-78100.html

How to Manage the Global Business Plan http://smallbusiness.chron.com/manage-global-business-plan-78095.html

The Effects of Accounts Payable Terms on Cash Conversion Cycles & the Cost of Goods http://smallbusiness.chron.com/effects-accounts-payable-terms-cash-conversion-cycles-cost-goods-78099.html

What Is the Basic Purpose of Supply Chain Management? http://smallbusiness.chron.com/basic-purpose-supply-chain-management-78098.html

Accounting for Construction Contracts Under the Percentage of Completion Method http://smallbusiness.chron.com/accounting-construction-contracts-under-percentage-completion-method-78097.html

How to Identify a Top Priority http://smallbusiness.chron.com/identify-top-priority-78093.html

Impact on Internal Controls of a Business by Sarbanes Oxley Act http://smallbusiness.chron.com/impact-internal-controls-business-sarbanes-oxley-act-78096.html

About Gary W. Patterson

Gary W. Patterson, president & CEO of FiscalDoctor®, has worked internationally with over 200 companies spanning supply chain, technology, transportation, construction, and service industries and been interviewed or presented internationally at over 100 of the leading and most prestigious publications and groups in the world.

His 4 books include “Million Dollar Blind Spots: 20/20 Vision for Financial Growth” and “Find Your Million Dollar Blind Spots: 7 Thing You Need to Know.” For more information, visit http://www.fiscaldoctor.com and his “free” fiscal fitness test at https://fiscaldoctor.com/fiscal-quiz.

© Gary W. Patterson All rights reserved.